From the 1st of November, Australian Company Directors are required by law to verify their identity with the Australian Business Registry Service and obtain a Director ID.

Directors will be provided with a unique Director Identifier Number (DIN) and, once issued, will keep that number forever. Directors must apply themselves. No one can apply on your behalf (not even your authorised agent). You must only apply for a single DIN.

The DIN is a 15 digit identifier which allows directors to be identified on public registers rather than by way of personal information such as full name, DOB and address. The DIN will also be used to trace relationships to companies. This will allow regulators to identify and track illegal phoenixing activity and to track directors of failed companies who use fictitious identities.

For more information, please click the link below:

When must you comply?

You can apply for a director ID now.

If you’re planning on becoming a director, you can apply before you’re appointed.

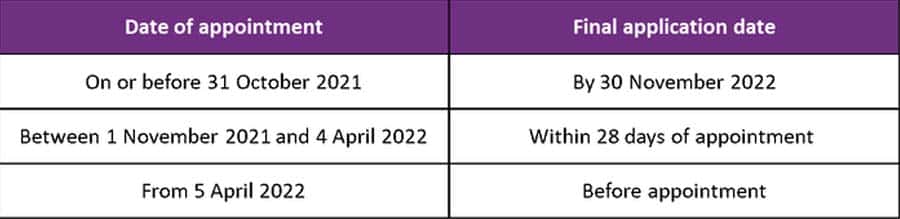

Please refer to the table below.

How can you get your Director ID?

There are three ways to apply for a director ID number. The fastest way, and the preferred method, is to apply online.

Access the following documents for more information

Online application

Click the link below which outlines the steps:

You will need a myGovID with a standard or strong identity strength to apply for their director ID online. The following will be needed to make an online application:-

1) download the myGovID app from this link;

2) when you have the myGovID, you will need to gather all supporting documentation:-

- their tax file number (TFN);

- their residential address as held by the ATO; and

- information from two documents to verify their identity.

Examples of the documents which can be used to verify a person’s identity include:-

- bank account details

- an ATO notice of assessment

- super account details

- a dividend statement

- a Centrelink payment summary

- a PAYG payment summary.

3) Once you have all the information for verifying their identity, you can click on the link and apply for your Director ID. The application process should take less than 5 minutes.

Phone application

A phone application can be made by calling 13 62 50. Before making that call, the applicant should gather:-

- their tax file number (TFN);

- their residential address as held by the ATO; and

- information from two documents to verify their identity.

To establish a person’s identity, they may be asked questions based on their tax or superannuation information, including information from third parties and other government departments. This may include details from ATO letters or notices that have been issued to the applicant, details from a tax return, or other information that will help to verify the applicant’s identity.

The applicant may also be asked to confirm details of identity documents, such as their driver’s licence, Medicare card or passport, and to consent to those documents being checked with the issuing authority.

Paper application

It is also possible to apply using a downloadable form (see link below). This is a slower process (taking around 28 days) and certified copies of identity documents will need to be included to verify the applicant’s identity. The originals of these documents must not be submitted. The paper application needs to be posted to the Australian Business Registry Services, Locked Bag 6000, Albury 2640.

You can also apply for your Director ID via Paper form or over the phone (13 62 50)

What to do once you have your Director ID

Once you have completed your Director ID process, and you have been issued with a Director ID, can you please email the DIN to our firm at info@ajbuckingham.com.au

If you have any questions or issues please contact us on 03 9435 4444.