One Off Cost of Living Tax Offset Increased

The March Federal Budget will increase the existing low and middle income tax offset (LMITO) by $420 for the 2021-22 income year only. Accordingly, eligible individuals will receive the maximum LMITO benefit of $1,500 (up from $1,080) to be calculated automatically in their tax return.

Medicare Levy Low Income Thresholds Increased

From 1 July 2021, the Medicare low-income thresholds for seniors, pensioners, families and singles will increase as follows:

- The threshold for singles will be increased from $23,226 to $23,365.

- The family threshold will be increased from $39,167 to $39,402.

- For single seniors and pensioners, the threshold will be increased from $36,705 to $36,925.

- The family threshold for seniors and pensioners will be increased from $51,094 to $51,401.

For each dependent child or student, the family income thresholds will increase by a further $3,619 instead of the previous amount of $3,597.

NOTE: Legislation is yet to be ratified for these new thresholds.

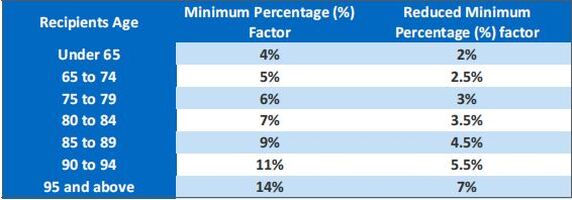

Extension of the 50 per cent Reduction to the Superannuation Minimum Payment Requirements

The Federal Government announced the extension of the current 50 per cent reduction in the minimum superannuation drawdown requirements for account-based pensions (ABPs) and similar products. This measure was put in place in March 2020 and has now been extended to 30th June 2023.

This concession was put in place to support self-funded retirees’ due to the significant losses in financial markets as a result of the COVID-19 crisis negatively impacting the account balance of the superannuation pension or annuity investments by ensuring they do not have to sell investment assets to fund the otherwise higher minimum drawdown requirements.

COVID-19 Tax ConcessionsThe Government introduced a measure on 13 September 2020 enabling certain eligible state and territory COVID-19 business support programs to be made non-assessable non-exempt income (‘NANE’) for income tax purposes. This has now been extended until 30 June 2022.From 1st July 2021 the costs of taking a work-related COVID-19 test (including Polymerase Chain Reaction (PCR) and Rapid Antigen Tests (RAT)) are tax deductible for individuals from 1 July 2021. Businesses will not incur Fringe Benefits Tax (FBT) where they provide employees with COVID-19 tests for employees to attend work. This measure will be in place permanently from the beginning of the 2021-22 income year.

Skills and Training Boost for Businesses

The Budget introduced a skills and training boost to support small and medium-sized businesses (with aggregated annual turnover of less than $50 million) to be able to deduct an additional 20 per cent of expenditure incurred on external training courses provided to their employees (i.e. not on-the-job or in-house training). The external training courses will need to be provided to employees in Australia or online, and delivered by entities registered in Australia.

The eligible expenditure incurred from 7:30pm (AEDT) on 29 March 2022 to 30 June 2022 will be claimed in the 2023 income year, while the 20% boost for expenditure incurred between 1 July 2022 and 30 June 2024 would be included in the income year the expenditure is incurred.

Technology and Investment Boost for BusinessesThe intention of this incentive is to encourage small businesses to invest in depreciating assets that support digital adoption technologies (for example,

portable payment devices, cyber security systems or subscriptions to cloud based services).Small and medium-sized businesses (with aggregated annual turnover of less than $50 million) will be able to deduct an additional 20% of eligible expenditure incurred on business expenses and depreciating assets up to the annual cap of $100,000 for each qualifying income year. This equates to a

maximum additional deduction of $20,000 per eligible year.

For eligible expenditure incurred by 30 June 2022, the boost will be claimed in tax returns for the following income year.

For eligible expenditure incurred between 1 July 2022 and 30 June 2023, the boost will be claimed in the income year in which the expenditure is incurred.

Electronic Lodgement of Trust Income Returns

The March 2022 Budget evidenced continued focus on business tax compliance and included the digitalisation of trust and beneficiary income reporting and processing by allowing, as of 1st July 2024, all trust return filers the option to lodge income tax returns electronically, increasing pre-filling and automating ATO assurance processes.

Previously excluded from electronic lodgement requirements, this measure acknowledges that trust income reporting has not been automated to the same extent as individual and company tax returns and its introduction should reduce the compliance burden, reduce processing times, and enhance ATO processes.