What if all your marketing efforts including your website, advertising and social media strategies all started to work at once? Sounds like a ‘perfect storm’ most small business owners would like to have but how would you cope if you were inundated with phone calls, leads, enquiries and sales? Do you have the systems and resources in place to handle the calls, orders and delivery deadlines?

This marketing explosion could stretch your resources to breaking point and failure to return customer calls and emails on time could damage your brand and undo all your hard work.

Courtesy of technology and social media you can grow a million dollar business faster than ever before but many entrepreneurs fail to plan for the ‘perfect marketing storm’. Below we provide some tips on what preparation needs to be made when everything falls into place.

Growth Targets

Have you set goals for your business? What level of turnover, profit and staff are required if your business reaches these targets? What time frame are you looking at and what milestones have you pegged? Be clear on what you are targeting for and why. Knowing the answer to these questions will dictate the action steps that you need to take.

Financing the Growth

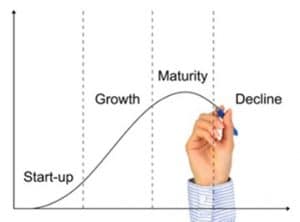

The start-up phase aside, growth spurts are the second most risky time for a business. Growth can squeeze cash flow, which could mean there may simply not be enough money available when bills fall due. The state of your working capital is crucial at this time and to get ready for the growth spurt you need to be clear on how you will fund the boom. It could be from retained earnings, through supplier credit terms or finance from a bank or other source.

Delegate or Outsource?

Rapid growth may mean transitioning from sole trader to literally running a business team overnight. Entrepreneurs need to examine what they spend their time doing and continue working on high return activities. The low end tasks need to be delegated or outsourced. Just be careful when delegating or outsourcing that your service standards don’t drop. Often, the biggest constraint for a fast growing business is accessing quality, experienced and stable staff. While contract staff may work well in some situations, it’s not a model that works for a business with a history of sustained growth.

Many businesses are built on the back of an entrepreneur’s single idea or skill. These businesses will often require injections of additional skills and knowledge to grow into larger businesses and you need to either build your knowledge and skill or recruit people who do have the skills.