Increase in ASIC Fees

The Government has revealed an increase in the cost of registering a business name with the Australian Securities and Investments Commission (ASIC). Fees increase from $30 for one year and $70 for three years to $32 and $74 respectively.

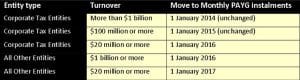

Large Entities Subject to Monthly PAYG Instalments

The Government will extend the requirement to make monthly PAYG instalments for all large entities (turnover of $20 million or more) in the PAYG instalment system. This includes trusts, superannuation funds, sole traders and large investors. Other entities will be progressively brought in from the third tranche of the already announced move to monthly PAYG instalments for corporate entities:

Entities, other than head companies or provisional head companies, that have a turnover of less than $100 million and report GST on a quarterly or annual basis will not be required to pay PAYG instalments monthly. In addition, entities in the taxation of financial arrangements (TOFA) regime will assess their entry to monthly instalments using a modified turnover test, based on their gross TOFA income, rather than their net TOFA income.

Entities, other than head companies or provisional head companies, that have a turnover of less than $100m and report GST on a quarterly or annual basis will not be required to pay PAYG instalments monthly.

Tightening measures

Business taxation changes introduced in the 2013/14 budget include a tightening of measures that aim to prevent multi-national businesses shifting tax deductible loans to Australian subsidiaries. The Government said it will “address aggressive tax structures that seek to shift profits by artificially loading debt into Australia”. Other loopholes and abuses include tightening the thin capitalisation rules and removing the interest expense deduction for deriving certain foreign exempt income. This and related measures will apply from July 1, 2014.