The Government will maintain changes to reduce personal income tax.

This measure is designed to continue to stimulate the economy by increasing the disposable income available to individuals.

Income Tax Offsets

The Treasurer confirmed that the Low and Middle Income Tax Offset (LMITO) will be retained for the 2021/22 income tax year. It provides a reduction in tax of up to $255 for taxpayers with a taxable income of $37,000 or less. The LMITO will increase at a rate of 7.5 cents for every dollar of taxable income between $37,000 and $48,000 and taxpayers with taxable incomes between $48,000 and $90,000 will receive the full $1,080.

For taxpayers with a taxable income over $90,000, the LMITO will phase out at a rate of 3 cents for every additional dollar of taxable income. It will phase out completely at a taxable income of $126,000.

The Low Income Tax Offset (LITO) will also continue to apply for the 2021/22 income tax year. For taxpayers with taxable incomes of less than $37,000, the offset is $700. The offset then reduces at a rate of 5 cents for each dollar of taxable income to $45,000 and at a rate of 1.5 cents for each subsequent dollar of taxable income, completely phasing out for taxable incomes above $66,668.

Personal Tax Rates

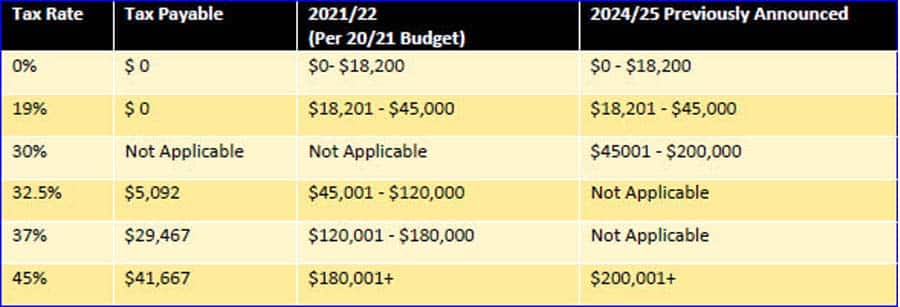

There have been no changes to the personal income tax rates for the 2021/22 income year. Stage 3 of the Government’s personal income tax plan remains unchanged and should commence from July 1, 2024.

The table below summarises the resident personal tax rates and thresholds (excluding the 2% Medicare levy).

Medicare Levy Low-Income Thresholds

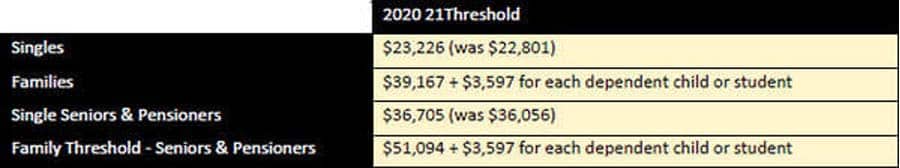

For the 2020/21 income year, the Medicare levy low income threshold for singles will be increased to $23,226 (up from $22,801). For couples with no children, the family income threshold will be increased to $39,167 (up from $38,474). For each dependent child or student, the family income threshold will increase by $3,597 (up from $3,533).

For single seniors and pensioners eligible for the seniors and pensioners tax offset, the Medicare levy low income threshold will be increased to $36,705 (up from $36,056). The family threshold for seniors and pensioners will be increased to $51,094 (up from $50,191).

Simplifying Deductions for Self-Education Expenses

Currently, individuals undertaking a prescribed course of education are only entitled to deduct the excess of the expenses incurred over $250. This exclusion of the first $250 of eligible self-education expenses is to be removed and this measure will take effect from the first income year after the date the amending legislation receives Royal Assent.

Simplifying the Australian Residency Rules

The existing tests for the tax residency of individuals will be replaced by a primary ‘bright line’ test. Any person who is physically present in Australia for 183 days or more in any income year will be an Australian tax resident.

Simplifying Employee Share Schemes

Leaving an employer will no longer be a taxing point for employee share scheme entitlements. This means that tax deferral for the employee share scheme entitlements will continue until forfeiture conditions have passed and shares held are able to be freely sold, subject to the maximum 15-year tax deferral period. Currently, forfeiture conditions and sales restrictions are often lifted at the time employments ends. The value of shares that a company can issue to an employee under simplified disclosure requirements will also increase from $5,000 to $30,000 per year.