Selling your business is a significant undertaking that involves a complex web of financial intricacies, legal documents, and market dynamics. Beyond just your business’s financial performance, it’s essential to consider market trends when determining the optimal time to sell. This article delves into the various stages of completing a business sale, from pre-completion preparations to the critical post-completion obligations.

Understanding Market Trends

Before diving into the nitty-gritty of completing a business sale, it’s crucial to acknowledge how market trends can influence your decision to sell. Market conditions, demand for your industry, and economic fluctuations can all impact the timing of your sale. Keeping an eye on these trends can help you make informed choices about when to take the plunge.

Pre-Completion Preparations

Once you’ve made the decision to sell, there’s a series of preparatory steps to undertake before you reach the completion stage. Pre-completion actions are essential for ensuring a smooth transition on the big day, known as the completion day. Delays can occur if these steps are left to the last minute, so careful planning is key.

Here’s a breakdown of common pre-completion steps and the necessary documents:

- Review Business Sale Agreement: Both the buyer’s and seller’s lawyers must meticulously review the business sale agreement to ensure compliance with all requirements.

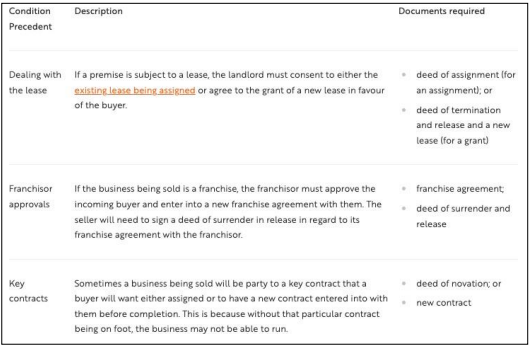

- Conditions Precedent: Within the sale agreement, there are typically conditions that must be met before the completion date. Failure to satisfy these conditions can allow one party to walk away from the sale. These conditions often require specific documentation for fulfillment.

The table below sets out some common pre-completion steps and the documents required to satisfy them.

The table below sets out some common conditions’ precedent in a business sale and the documents required to satisfy them.

Completion Day

Completion day marks the culmination of your business sale journey. While the specifics of this day can vary widely depending on your business type and assets involved, there are fundamental obligations present in nearly every sale. On this day, both parties must collaborate to fulfill their respective responsibilities.

Common completion day obligations include:

- Transfer of Ownership: Once all obligations are met, legal ownership of the business is transferred to the buyer.

- Financial Settlement: Payment is made to the seller, and any outstanding financial matters are resolved.

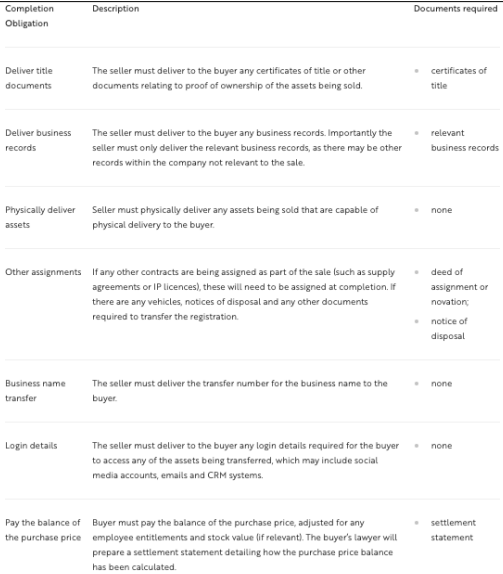

The table below sets out some common completion obligations in a business sale.

Post-Completion Responsibilities

The sale doesn’t necessarily end on completion day, as there can be post-completion obligations, particularly for the seller. These responsibilities often include providing training to the buyer on business processes and being available for technical assistance for a specified period after the sale. Restraint obligations may also apply for a set time post-completion.

Key Takeaways

Navigating the process of completing a business sale can be a complex and demanding journey. It’s essential to understand that this journey comprises three critical phases: pre-completion preparations, the day of completion, and post-completion obligations. Each phase involves distinct documents, requirements, and responsibilities.

Of utmost importance are the conditions precedent in the pre-completion phase. Failure to fulfill these conditions can grant the other party the right to terminate the agreement. As for the buyer, non-compliance may even result in the refund of their deposit.

To ensure a smooth and successful sale, it’s wise to maintain a completion checklist to track progress and stay on top of your obligations. With careful planning and attention to detail, you can navigate the intricacies of completing the sale of your business with confidence and success.