Business planning is always challenging but planning with a pandemic in the background is incredibly difficult given the uncertainty and international travel restrictions. Border closures have impacted supply chains and some industries have slowed dramatically. As a consequence, for many businesses, the number one priority right now is cash flow.

As we approach the end of the 2021 financial year, tax planning has never been more important and as accountants, we believe our client brief includes helping you minimise your tax liability within the framework of the Australian taxation system.

The purpose of this article is to highlight some end of year tax planning opportunities but you need to be proactive and act quickly to take advantage of these strategies.

To assist you we have put together a list of strategies to consider before June 30 and note:

- To maximise benefits for the current financial year, we suggest you prepare a preliminary calculation of your taxable income for the year ending June 30, 2021 to identify the size of your likely tax debt and establish if you have a tax ‘problem’.

- Review all tax-deductible expenses and assessable income in the latest available figures to determine the possibility of pre-paying some expenses before June 30 or deferring some revenue until after July 1, 2021.

Please note, the following list of tax planning opportunities is certainly not exhaustive and depending on your circumstances (including your turnover and whether you are on a cash or accruals method of accounting), some conditions may apply that restrict your use of these strategies.

If you would like to discuss your tax planning options, we urge you to contact us and most importantly, don’t leave it until the last minute as some of these strategies require some time to implement.

Key Tax Minimisation Strategies

1. Delay Deriving Assessable Income

One effective strategy is to delay deriving your income until after June 30, 2021 by:

a) Delaying the timing of the derivation of income until after June 30

b) Timing of raising invoices for incomplete work (businesses).

Where this strategy will not adversely affect your cash flow, consideration should be given to deferring the recognition of income until after 30 June 2021. Please note, not banking amounts received before June 30 until after June 30 does NOT qualify because the income is deemed to have been earned when the money is received or the goods or services are provided (depending on whether you are on a cash or accruals basis of accounting).

- Cash Basis Income – Some income is taxable on a cash receipts basis rather than on an accruals basis (e.g. rental income or interest income in certain cases). You should consider whether some income can be deferred in those instances.

- Consider delaying the raising of your invoices to customers until after July 1 which will push the derivation of the income into the next financial year and defer the tax payable on that income. If you operate on the cash basis of accounting, you simply need to delay receiving the money from your customers until after June 30.

- Lump Sum Amounts – Where a lump sum amount is likely to be received close to the end of a financial year, you should consider whether this amount (or part thereof) can be delayed or spread over future periods.

2. Bringing Forward Deductible Expenses or Losses

Prepayment of Expenses – In some circumstances, Small Business Entities (SBE) and individuals who derive passive type income (such as rental income and dividends) should consider pre-paying expenses prior to 30 June, 2021. A tax deduction can be brought forward into this financial year for expenses like:

- Employee Superannuation Payments including the 9.5% Superannuation Guarantee Contributions for the June 2021 quarter (that have to be received by the Superannuation Fund by June 30, 2021 to claim a tax deduction)

- Superannuation for Business Owners, Directors and Associated Persons

- Wages, Bonuses, Commissions and Allowances

- Contractor Payments

- Travel and Accommodation Expenses

- Trade Creditors

- Rent for July 2021 (and possibly future additional months)

- Insurances including Income Protection Insurance

- Printing, Stationery and Office Supplies

- Advertising including Directory Listings

- Utility Expenses – Telephone, Electricity and Power

- Motor Vehicle Expenses – Registration and Insurance

- Accounting Fees

- Subscriptions and Memberships to Professional Associations and Trade Journals

- Repairs and Maintenance to Investment Properties

- Self Education Costs

- Home Office Expenses – desk, chair, computers etc.

- Donations to deductible gift recipient organisations

- If appropriate, consider prepaying any deductible investment loan interest. This could include interest payments on an investment loan for either an investment or commercial property or an investment portfolio you hold.

A deduction for prepaid expenses will generally be allowed where the payment is made before June 30, 2021 for services to be rendered within a 12 month period. While this strategy can be effective for businesses operating on a cash basis (not accruals basis), we never recommend you spend money on items you don’t need.

However, paying expenses in June that are due in July could save you some tax this financial year. Of course, this only works if you have sufficient cash flow to prepay the expenses.

Superannuation Contributions – some low or middle-income earners who make personal (after-tax) contributions to a superannuation fund may be entitled to the Government co-contribution. The amount of Government co-contribution will depend on your income and how much you contribute. (Refer to the Superannuation Section below for more information).

Capital Gains/Losses – Note that the contract date (not the settlement date) is often the key sale date for capital gains tax purposes and when it comes to the sale of an asset that triggers a capital gain or capital loss, you need to consider your overall investment strategy when making the decision to sell. Here are several important points regarding the management of capital gains and capital losses on sale of your assets from a tax planning perspective:

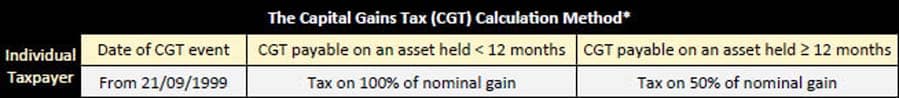

i) If appropriate, consider deferring the sale of an asset with an expected capital gain (and applicable capital gains tax liability) until it has been held for 12 months or longer. By doing so, you could reduce your personal income tax. For example, if you hold an asset for under 12 months, any capital gain you make may be assessed in its entirety upon the sale of that asset.

*A capital gain will be assessable in the financial year that it’s crystallised.

ii) If appropriate, consider deferring the sale of an asset with an expected capital gain (and applicable capital gains tax liability) to a future financial year. By doing so, you could help reduce your personal income tax for the current financial year. This could also be of benefit if, for example, you expect that your income will be lower in future financial years compared to the current year.

iii) If appropriate, consider off-setting a crystallised capital gain with an existing capital loss (carried forward or otherwise) or bringing forward the sale of an asset currently sitting at a loss. By doing so, you could reduce your personal income tax in this financial year. Note that a capital loss can only be used to offset a capital gain.

Accounts Payable (Creditors) – If you operate on an accruals basis and services have been provided to your business, ensure that you have an invoice dated June 30, 2021 or before, so you can take up the expense in your accounts for the year ended 30th June 2021.

Businesses Should Also Consider:

Review your Stock on Hand and Work in Progress listings before June 30 to ensure that it is valued at the lower of Cost or Net Realisable Value. Any stock that is carried at a value higher than you could realise on sale (after all costs associated with the sale) should be written down to that Net Realisable Value in your stock records.

As mentioned above, if you want a tax deduction in the 2020/21 financial year, the superannuation fund must receive the funds by June 30, 2021. The Tax Office doesn’t consider a contribution to be made until the amount is actually credited to a super fund’s bank account so an electronic transfer to another bank account on June 30 is not necessarily considered paid. We strongly recommend you make the payment a week or so before June 30 and then follow up with the super fund to ensure the funds have been received. Don’t risk the tax deductibility of what can often be a significant amount by leaving the payment to the last minute.

If you operate on an accruals basis of accounting (as distinct from a cash basis) you should write off bad debts from your debtors listing before June 30. A bad debt is an amount that is owed to you that you consider is uncollectable or not economically feasible to pursue collection. Unless these debts are physically recorded as a ‘bad debt’ in your system before June 30, 2021, a deduction will not be allowable in the current financial year.

Where possible and cash flow permits, consider bringing these repairs forward to before June 30. If you don’t understand the distinction between a repair and a capital improvement, please consult with us because some capital improvements may not be tax deductible in the current year and could be claimable over a number of years as depreciation.

These should be scrapped or decommissioned prior to June 30, 2021 to enable the book value to be claimed as a tax deduction.

The accelerated depreciation and instant asset write-off concession for small businesses has been extended. The eligibility criteria and threshold for the instant asset write-off have changed over time. Any business with an aggregated turnover of up to $500 million will be able to claim a tax deduction for each asset purchased and first used or installed ready for use before June 30, 2021. Qualifying assets can cost up to the $150,000 threshold.

In addition, until 30th June 2022, Temporary Full Expensing means the instant asset write-off thresholds don’t apply as this allows an immediate deduction for:

- the business portion of the cost of new eligible depreciating assets for businesses with an aggregated turnover under $5 billion

- the business portion of the cost of eligible second-hand goods for businesses with an aggregated turnover under $50 million

- the balance of a small business pool at the end of each income year in this period for businesses with an aggregated turnover under $10 million.

In other words, for assets you purchased and first used (or have installed ready for use) for a taxable purpose from 7.30pm (AEDT) on 6 October 2020 to 30 June 2022, the instant asset write-off threshold does not apply. You can immediately deduct the business portion of the asset’s cost under temporary full expensing.

Click here to see the instant asset write-off tables for small businesses.

Newly acquired depreciating assets valued at more than $30,000 (or $150,000 post 12th March 2020) and not applied to the instant asset write off deduction can be added to the general business pool. As part of the backing business incentive, an accelerated depreciation deduction of 57.5 percent for the business portion of the new depreciating asset applies for the cost of an asset on installation from 12th March 2020 to 30th June 2021 and existing depreciation rules apply (15 per cent for the first year and 30 per cent for subsequent years) to the balance of the asset’s cost and for subsequent years. There is no limit to the cost of a qualifying depreciating asset eligible for this concession, but the asset must be new and not second hand.

Checklist of Other Year End Tax Issues

In addition to the tax planning opportunities, there are a number of obligations in relation to the end of the financial year including:

If you use a Motor Vehicle in producing your income you may need to:

- Record Motor Vehicle Odometer readings at June 20, 2021

- Prepare a log book for 12 continuous weeks if your existing one is more than 5 years old. Please note, if you commence the logbook prior to June 30, 2021, the usage determined will still be appropriate for the whole of 2020/21. As such, it is not too late to start preparing one for the current financial year. (Tip – the ATO has an App that can assist with keeping records such as business use logbooks – https://www.ato.gov.au/General/Online-services/ATO-app/myDeductions/?=Redirected_URL )

If you have started an account-based pension:

- Ensure that you have withdrawn the annual minimum required.

If you are in business or earn your income through a Company or Trust:

- Employer Compulsory Superannuation Obligations: The deadline for employers to pay Superannuation Guarantee Contributions for the 2020/21 financial year is July 28, 2021. However, if you want to claim a tax deduction in the 2020/21 financial year the super fund (or Small Business Superannuation Clearing House) must receive the contributions by June 30, 2021. You should therefore avoid making contributions at the last minute because processing delays could deny you a significant tax deduction in this financial year.

- For Private Company – Div 7A Loans – Business owners who have borrowed funds from their company in prior years must ensure that the appropriate principal and interest loan repayments are made by June 30, 2021. Current year loans must be either paid back in full or have a loan agreement entered into before the due date of lodgement of the company return. Failure to comply risks having it counted as an unfranked dividend in the individual’s tax return.

- Preparation of Stock Count Working Papers at June 30, 2021.

Preparation and reconciliation of Employee PAYG Payment Summaries (formerly known as Group Certificates). Note you are not required to supply your employees with payment summaries for amounts you have reported and finalised through Single Touch Payroll. - Trustee Resolutions – ensure that the Trustee Resolutions on how the income from the trust is distributed to the beneficiaries are prepared and signed before June 30, 2021 for all Discretionary (Family) Trusts. If a valid resolution hasn’t been executed by this date, the default beneficiaries become entitled to the trust’s income and are then subject to tax. Income derived but not distributed by the trust will mean the trust will be assessed at the highest marginal rate on this income.

- Company Tax Rates For Small Businesses: The company tax rate for base rate entities with less than $50 million turnover reduced to 26% for the 2020/21 year. This rate will reduce to 25% for the 2021/22 income year. A base rate entity is a company that both:

- has an aggregated turnover less than the aggregated turnover threshold ($50 million for the 2018/19 & 2019/20 income years)

- 80% or less of their assessable income is base rate entity passive income – this replaces the requirement to be carrying on a business.