It’s been an extraordinary end to the 2020 financial year with many businesses being forced into hibernation due to COVID-19. The number one priority for most business owners right now is survival and cash flow is critical.

As such, tax planning has never been more important and as your accountants, we believe our client brief includes helping you minimise your tax liability within the framework of the Australian taxation system. With June 30 fast approaching you need to make some key tax planning decisions now and we recommend you prepare a preliminary calculation of your taxable income for the year ending June 30, 2020. The purpose is to identify if you have a tax problem and the size of your likely tax debt.

The following list of tax planning opportunities is certainly not exhaustive and depending on your circumstances (including your turnover and whether you are on a cash or accruals method of accounting), terms and conditions may apply to some of these tactics. If you would like to discuss your tax planning options we urge you to contact us today and most importantly, don’t leave it until the last minute as some of these strategies require some time to implement.

Key Tax Minimisation Strategies

1. Delay Deriving Assessable Income

One effective strategy is to delay deriving your income until after June 30, 2020 by:

a) Delaying the Timing of the Derivation of Income until after June 30.

b) Timing the Raising of Invoices for Incomplete Work

Where this strategy will not adversely affect your cash flow, consideration should be given to deferring the recognition of income until after 30 June 2020. Please note, not banking amounts received before June 30 until after June 30 does not qualify because the income is deemed to have been earned when the money is received or the goods or services are provided (depending on whether you are on a cash or accruals basis of accounting).

- Cash Basis Income – Some income is taxable on a cash receipts basis rather than on an accruals basis (e.g. rental income or interest income in certain cases). You should consider whether some income can be deferred in those instances

- Consider delaying the raising of your invoices to customers until after July 1 which will push the derivation of the income into the next financial year and defer the tax payable on that income. If you operate on the cash basis of accounting, you simply need to delay receiving the money from your customers until after June 30.

- Lump Sum Amounts – Where a lump sum amount is likely to be received close to the end of a financial year, you should consider whether this amount (or part thereof) can be delayed or spread over future periods.

2. Bringing Forward Deductible Expenses or Losses

Prepayment of Expenses – In some circumstances, Small Business Entities (SBE) and individuals who derive passive type income (such as rental income and dividends) should consider pre-paying expenses prior to 30 June 2020. A tax deduction can be brought forward into this financial year for expenses like:

- Employee Superannuation Payments including the 9.5% Superannuation Guarantee Contributions for the June 2020 quarter (that have to be received by the Superannuation Fund by June 30, 2020 to claim a tax deduction).

- Superannuation for Business Owners, Directors and Associated Persons

- Wages, Bonuses, Commissions and Allowances

- Contractors

- Travel and Accommodation Expenses

- Trade Creditors

- Rent for July 2020 (and possibly additional months)

- Insurances

- Printing, Stationery and Office Supplies

- Advertising including Directory Listings

- Utility Expenses -Telephone, Electricity& Power

- Motor Vehicle Expenses – Registration and Insurance

- Accounting and Bookkeeping fees

- Subscriptions and Memberships to Professional Associations and Trade Journals

A deduction for prepaid expenses will generally be allowed where the payment is made before 30 June 2020 for services to be rendered within a 12-month period. While this strategy can be effective for businesses operating on a cash basis (not accruals basis), we never recommend you spend money on items you don’t need. This is so important if you are having a cash flow crisis right now. However, paying expenses in June that are due in July could save you some tax this financial year. Of course, this only works if you have sufficient cash flow.

- Superannuation Contributions – some low or middle-income earners who make personal (after-tax) contributions to a superannuation fund may be entitled to the government co-contribution. The amount of government co-contribution will depend on your income and how much you contribute.

- Capital Gains/Losses – the timing of the asset sale is critical and deferring the sale until after June 30 will defer the tax. Of course, if you have made other capital gains during the financial year it could be worth bringing forward the sale of an asset and crystallizing the loss, so you can offset it against the other capital gains. Note that the contract date is often the key date for when a sale has occurred for capital gains tax purposes, not the settlement date.

- Accounts Payable (Creditors) – If you operate on an accruals basis and services have been provided to your business, ensure that you have an invoice dated June 30, 2020 or before, so you can take up the expense in your financial statements for the year ended 30th June 2020.

Businesses should also consider:

- Stock Valuation Options – Review your Stock on Hand and Work in Progress listings before June 30 to ensure that it is valued at the lower of Cost or Net Realisable Value. Any stock that is carried at a value higher than you could realise on sale (after all costs associated with the sale) should be written down to that Net Realisable Value in your stock records.

- Compulsory Superannuation Guarantee – as mentioned above, if you want a tax deduction in the 2019/20 financial year, the superannuation fund must receive the funds by 30 June 2020. The Tax Office doesn’t consider a contribution to be made until the amount is actually credited to a super fund’s bank account so an electronic transfer to another bank account on June 30 is not necessarily considered paid. We strongly recommend you make the payment a week or so before June 30 and then follow up with the super fund to ensure the funds have been received. Don’t risk the tax deductibility of what can often be a significant amount by leaving payment to the last minute.

- Write-Off Bad Debts–if you operate on an accruals basis of accounting (as distinct from a cash basis) you should write off bad debts from your debtors listing before June 30. A bad debt is an amount that is owed to you that you consider is uncollectable or not economically feasible to pursue collection. Unless these debts are physically recorded as a ‘bad debt’ in your system before 30th June 2020, a deduction will not be allowable in the current financial year.

- Repairs and Maintenance Costs – Where possible and cash flow permits, consider bringing these repairs forward to before June 30. If you don’t understand the distinction between a repair and a capital improvement, please consult with us because some capital improvements may not be tax deductible in the current year and could be claimable over a number of years as depreciation.

- Obsolete Plant and Equipment should be scrapped or decommissioned prior to June 30, 2020 to enable the book value to be claimed as a tax deduction.

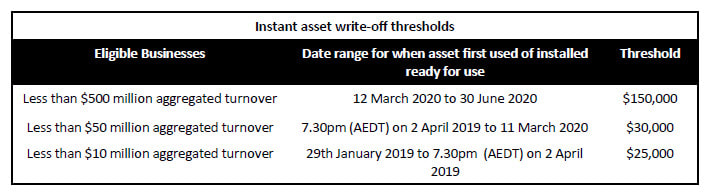

- Immediate Write Off for Individual Small Business Assets – As part of the Government Stimulus Package the accelerated depreciation and instant asset write-off for small businesses has been revised and expanded to $150,000 for any business with an aggregated turnover of up to $500 million (previously $50 million). Qualifying businesses will be able to claim a tax deduction for each asset purchased and first used or installed ready for use, up to the following certain thresholds.

Here are some key points to consider:

- For the instant asset write off the asset can be new or second hand.

- The amount must be under $150,000 (depending on date of purchase – could be $30K or $25K or $20K) exclusive of GST (i.e. $165,000, $33K, $27.5K or $22K including GST).

- If you borrow to purchase the asset, the asset is still eligible.

- The asset must be installed and ready to use by the deadline (purchasing a car to be delivered in July 2020 won’t qualify until the car is actually delivered).

- To claim the write off on a motor vehicle you will need to have a valid log book and claim only that percent-age of the cost as an immediate write off.

- If you purchase a car for your business, the instant asset write-off is limited to the business portion of the car limit of $57,581 for the 2019–20 income tax year.

- Some taxpayers may try to reduce the cost of an asset to under $30k (for purchases prior to 12th March 2020) by using a trade-in when purchasing the asset (for example a car). However, the monetary value of the trade-in will form part of the asset cost and not reduce the cost of the asset.

Any attempt to manipulate invoices etc. will attract the ATO’s use of the anti-avoidance rules, thereby eliminating the write off. - Building structural improvements are not eligible for the instant write off.

- If your pool balance at the end of the year is less than $30,000 before applying any other depreciation deduction, the entire pool balance can be written off ($150,000 if purchased post 12th March 2020).

- If your business is not a ‘Small Business Entity’ you will need to depreciate all assets purchased over $1000. Any assets purchased for $1000 or less can be written off immediately.

- As part of the backing business incentive, an accelerated depreciation deduction of 57.5 per cent for the business portion of the new depreciating asset applies for the cost of an asset on installation from 12th March 2020 to 30th June 2021 and existing depreciation rules apply (15 per cent for the first year and 30 per cent for subsequent years) to the balance of the asset’s cost and for subsequent years. There is no limit to the cost of a qualifying depreciating asset eligible for this concession, but the asset must be new and not second hand.

We encourage you to speak to us as soon as possible to assess your options and the steps you need to take well before the 30th June 2020.