Selling your business isn’t just about deciding; it’s about timing it right. The market conditions and industry performance during the sale can significantly influence the price you can fetch for your business. While there’s no precise formula for determining the perfect moment to sell, there are two vital factors that should guide your decision-making process:

1. Recent Financial Performance

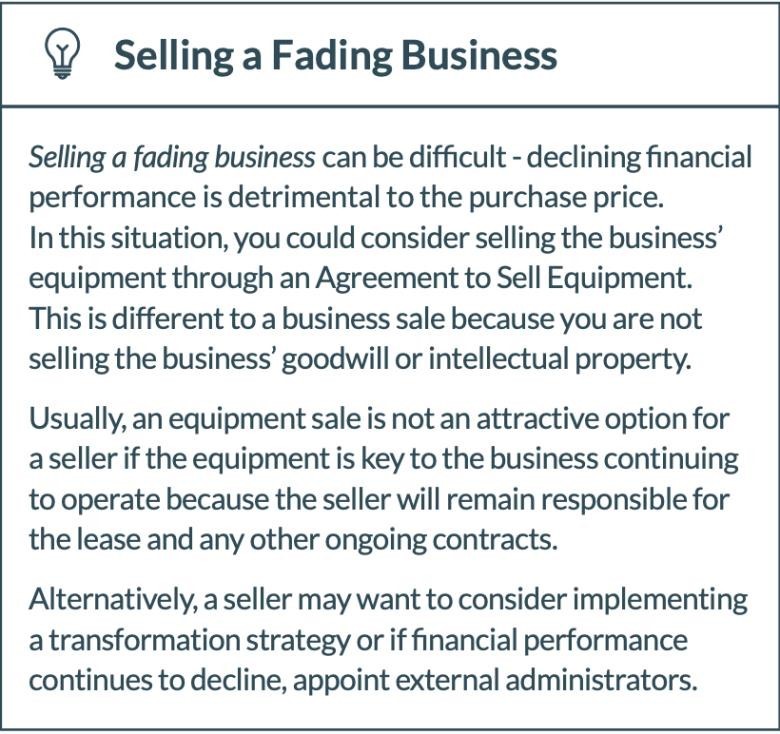

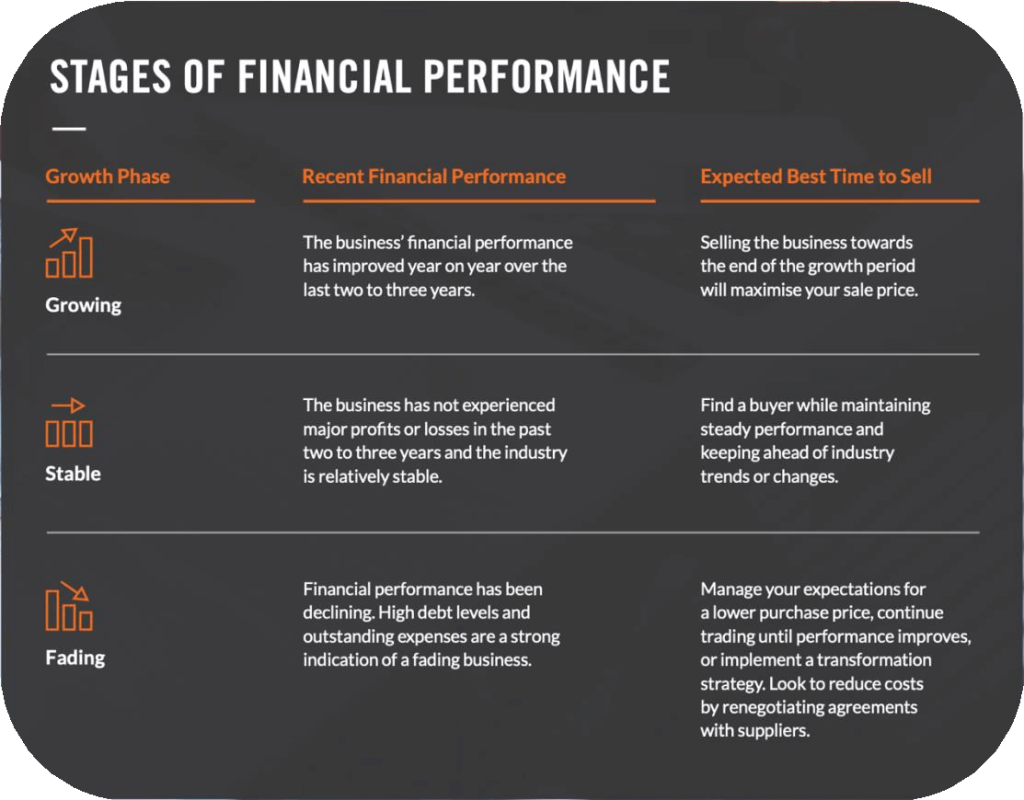

The financial health of your business plays a pivotal role in determining its selling price. As a seller, your objective should be to secure the highest possible price for your business. This price will hinge on several variables, including the trajectory of your business’s growth—whether it’s on the rise, stabilizing, or declining.

2. Market Research for Informed Decisions

There’s seldom an unequivocally “right time” to sell your business and pinpointing the “right price” is often an elusive goal. However, conducting thorough market research can prove invaluable when making decisions about when and how to sell your business.

Your market research should revolve around two key areas:

1. Future Demand for Your Product or Services

The value of your business is intrinsically linked to its future cash flows, which are in part shaped by the anticipated demand for your products or services. Economic and industry trends can exert profound, long-term influences on sales and profits. For example, during periods of high consumer confidence, people tend to spend more on discretionary goods and services, such as clothing and entertainment. This increased demand can allow business owners to charge higher prices.

To access economic and industry insights, begin by perusing the economics section of reputable publications like the Australian Financial Review. For a deeper dive, explore the economic analyses provided by the Reserve Bank of Australia. Additionally, the Australian Bureau of Statistics offers a wealth of industry-specific data that can be invaluable.

2. Demand for Your Business

Much like the housing market, the business market operates in cycles. If the demand for businesses like yours surpasses the supply, you have the leverage to command a higher price. For instance, if more people want to buy cafes than there are cafes available for sale, cafe owners can demand a premium when selling their business.

Assessing the relative levels of demand and supply for businesses can be challenging. One effective approach is to consult a business broker. These experts dedicate their days to monitoring the market, gauging demand, and evaluating supply. To get a well-rounded perspective on market conditions, consider speaking with three or four brokers from different organizations.

Furthermore, spend a few weeks studying listings for businesses like yours that are currently on the market. This exercise will provide valuable insights into your business’s potential value by answering questions like: What prices are these businesses selling for? How long does it take for them to sell?

Drafting an Exit Plan

Selling an unprepared business can negatively affect a buyer’s perception of your business and its final sale price. Before engaging with potential buyers, it’s essential to plan your exit by creating a comprehensive exit plan. This plan should outline the necessary steps to maximise the value of your business during the sale.

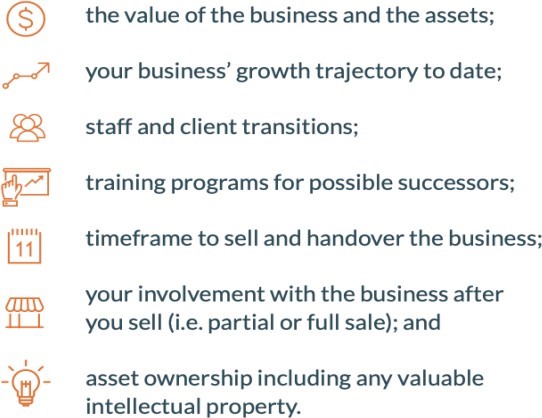

The exit plan should address several crucial aspects, including:

- Financial Preparation: Ensuring your financial records are accurate, up-to-date, and organised for due diligence.

- Operational Optimization: Streamlining your business operations to enhance efficiency and appeal to potential buyers.

- Legal and Compliance Matters: Ensuring that your business is compliant with all legal and regulatory requirements, including contracts and licenses.

- Marketing and Branding: Enhancing your business’s market presence and brand image to make it more attractive to buyers.

- Transition Planning: Outlining how the transition of ownership will occur, including any training or support you’ll provide to the new owner.

The exit plan should deal with:

Conclusion

In conclusion, selling your business at the right time and for the best price involves careful consideration of financial performance, market trends, and a well-thought-out exit plan. By addressing these key factors, you can increase your chances of a successful and profitable business sale.