The Government has announced measures that seek to build on previously legislated changes to reduce personal income tax over the next six years.

Low & Middle Income Tax Offset (LMITO)

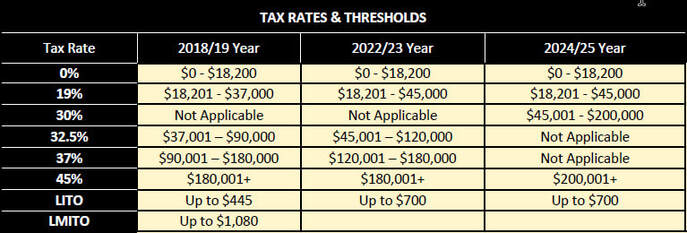

With immediate effect for the 2019 income year, the Government has proposed to increase the non-refundable low and middle-income tax offset (LMITO) to a maximum amount of $1,080 (up from $530) for taxpayers earning more than $48,000 but no more than $90,000. The LMITO then phases out from $90,001 to $126,000. The base amount of the LMITO is also proposed to increase from $200 to $255 for those earning no more than $48,000. This offset is in addition to the existing low-income tax offset (LITO) and is a temporary measure due to be removed on 30 June 2022.

Tax Rate Changes

With effect from 1 July 2022, the Government proposes to increase the top threshold of the 19% tax bracket from the previously legislated $41,000 to $45,000 and will also increase the LITO from the previously legislated amount of $645 to $700. These changes are intended to lock in the reduction in tax provided by the LMITO, once the LMITO is removed.

The Government has already legislated to remove the 37% tax bracket with effect from 1 July 2024. In this Budget, it announced a further change to reduce the 32.5% marginal tax rate to 30%, which will take effect at the same time. This means that taxpayers earning up to $200,000 will pay a maximum marginal tax rate of 30% from the 2025 income year. For that year, taxpayers will be able to earn fully franked dividends of approximately $158,000 without paying any top-up tax (assuming a franking rate of 30%) and approximately $90,000 (assuming a franking rate of 25%).

Tax Rates and Thresholds for 2018/19 Onwards

The table below summarises the announced personal tax rate and threshold changes (excluding the 2% Medicare levy).

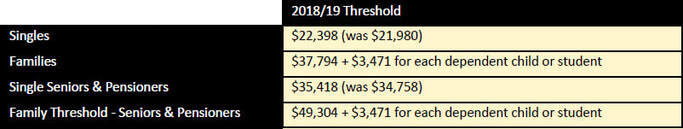

Medicare Levy Low-Income Thresholds for 2018/19

For the 2018/19 income year, the Medicare levy low-income threshold for singles will be increased to $22,398 (up from $21,980 in 2017/18). For couples with no children, the family income threshold will be increased to $37,794 (up from $37,089 in 2017/18). For each dependent child or student, the family income threshold will increase by $3,471 (up from $3,406 in 2017/18).

For single seniors and pensioners eligible for the seniors and pensioners tax offset, the Medicare levy low-income threshold will be increased to $35,418 (up from $34,758 in 2017/18). The family threshold for seniors and pensioners will be increased to $49,304 (up from $48,385), plus $3,471 for each dependent child or student.