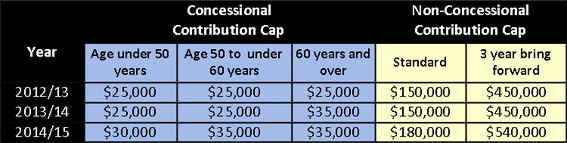

Contribution Caps

From 1 July 2014 there is indexation of contribution caps. Regular indexation of the caps was legislated back in 2007, however, it has been frozen in recent years.

Age Pension Eligibility & Preservation Age

The qualifying age for the age pension will become 70 by 1st July 2035. The qualifying age will increase by six months every two years transitionally for those born after 1st July 1958 as the previous government had already increased the retirement age to 67 as of 1st July 2025.At this stage the government is silent on whether there will be an increase in the age when individuals can access their superannuation to bring it into line with the revised retirement age.